How Does an MBill Work?

As a new product, an MBill will replace existing processes and procedures in the financing of new residential properties. Removing the need for the traditional 10% deposit, an MBill delivers a total funding solution.

An MBill is applied for, approved and secured at the time of purchase by a single up-front application.

By providing a finance and settlement guarantee for the contracted purchase price at the time a contract for sale is signed, an MBill will address many of the uncertainties associated with traditional approaches to financing the purchase of a new property.

The MBill Guarantee and the other MBill documents (including the standard MBill Sales Contract), ensure the purchaser and the issuer of the MBill Guarantee are fully protected from the risk of non-delivery.

When the property is completed in accordance with the MBill Sales Contract, the purchaser receives legal title and the MBill Issuer pays the MBill Holder.

An MBill in Action

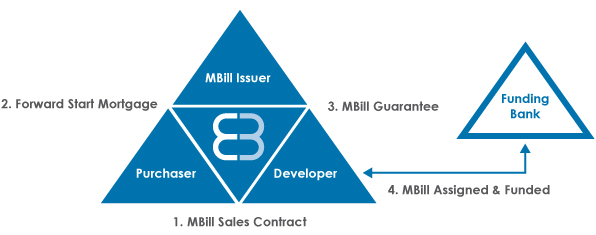

The Key MBill Mechanics Are:

Step 1 - At point of sale a property is identified by a purchaser and an MBill application is submitted to a licensed MBill Issuing Bank. An MBill Sales Contract is agreed between the purchaser and the developer subject to the MBill application.

Step 2 - The licensed MBill Issuing Bank approves an MBill Forward Start Mortgage and security is taken over current property, where required, and the property to be purchased. Once approved, the MBill Sales Contract is signed.

Step 3 - The MBill Issuing Bank provides an MBill Guarantee to the developer.

Step 4 - The developer secures funding by assigning the MBill Guarantee to their bank.